Matt Dancho – Backtesting Algorithmic Trading Strategies with Python

Build and Backtest Algorithmic Trading Portfolios with Python

…So You Can Grow Your Investments responsibly WITHOUT Risky Single-Stock Strategies Or Algorithmic Trading Experience

Why beginners fail at growing their investments…

- Don’t Know How to Get Started

Are you overwhelmed with the number of strategies out there for algorithmic trading? - Losing Money With Risky Single-Stock Strategies

Are you losing money on your first trades, do you feel uneasy with your single-stock risk, or are your trades underwater? - Lack of Financial Domain Experience

Do you find yourself struggling to gain confidence, understand financial jargon, and make sense of it all?

If that’s you…

Then keep reading, my friend, because what happens in the next few minutes could decide if you stay stuck for another year or gain the knowledge that will help you grow your investment portfolio responsibly.

Trust us, we know what it’s like…

- Trying single-stock moving average crossover strategies (and “bleeding red”)

- Spending money on courses that do NOT work

- To feel like I could be growing my investments more (but not knowing how)

- To feel like I’m taking on too much risk

- To try every YouTube trading strategy there is, and still lose money

What You’ll Learn In Backtesting Algorithmic Trading Strategies with Python

Step 1: Trading Project and Python Quant Lab Setup ($500 Value)

- Get the Quant Stack Python Software installed

- Set up your algorithmic trading project

- Create your Python environment

- Everything you need to begin building and backtesting portfolio trading strategies

Step 2: How to Create a Profitable Algorithmic Portfolio Trading Strategy ($2,500 Value)

- Get our top portfolio-based trading strategy: Volatility targeting with auto-rebalancing ($2,500 Value)

- Get our code template for how to construct a risk-managed portfolio with the Riskfolio-Lib Python library

- Discover how to increase returns using the “Ray Dalio Bridgewater Cheat Code”

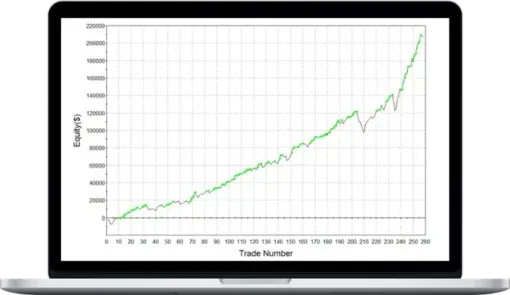

Step 3: Learn how to Backtest the right way ($2,500 Value)

- Detailed walkthrough of event-based backtesting ($2,500 Value)

- Backtested portfolio strategies with Zipline Reloaded

- How to avoid mistakes in backtesting portfolios

- How to include rebalancing, slippage, and trading commissions