Wyckoff Analytics – Wyckoff Trading Course Part 2

Description of Wyckoff Trading Course Part 2

Prerequisite: Wyckoff Trading Course Part 1

Visual Skill Building — “Practicum” Designed as the next logical step for graduates of the WTC Part I, every element of this course emphasizes increasing proficiency in the Wyckoff Method through deliberate practice involving rigorous exercises and drills.

Tactics and Trade Management Wyckoff techniques in trade management and visual pattern recognition are further developed through analysis of how the price structure could unfold under different plausible scenarios and how to quickly identify confirmation or failure of each alternative.

Advanced Wyckoff Analysis Meticulous studies of Wyckoff phase behaviors, trend recognition and variations in volume signatures, all illustrated with historical market structures, will deepen your foundational knowledge of the Wyckoff Method, helping you refine and elevate your trading.

What will you learn in Wyckoff Trading Course Part 2?

Visual Recognition Skill — “Practicum”

- Applied Knowledge Your understanding of the Wyckoff Method acquired in WTC Part I will be markedly enhanced through a carefully sequenced series of rigorous, interactive classes.

- Drills and Exercises Wyckoff concepts are applied in numerous in-class exercises (“learning by doing”), designed to sharpen your skills in chart pattern recognition and trading tactics.

- Concentration on Bias and Timing Special focus on supply and demand confirmation of directional bias and timing, which can help you determine when to establish a position in anticipation of a favorable move.

Trading Tactics and Management

- Price Structure Scenarios In-class drills and discussions help you learn to anticipate future price movement through visualization of alternative Wyckoff price structure scenarios — including how to identify failure or confirmation of each.

- Trade Management Clear recognition and best practices regarding entry and exit points, stop-loss placement and movement, and proper scaling in and out of positions.

- Risk Management Basic risk mitigation techniques, including estimating the probable risk and reward of any trade based on recognition of the market operations of institutional players.

- Filtering Trade Candidates Exercises to optimize candidate selection using the Wyckoff Method approach to market structure, supply and demand, and comparative and relative strength analysis.

Advanced Wyckoff Analysis

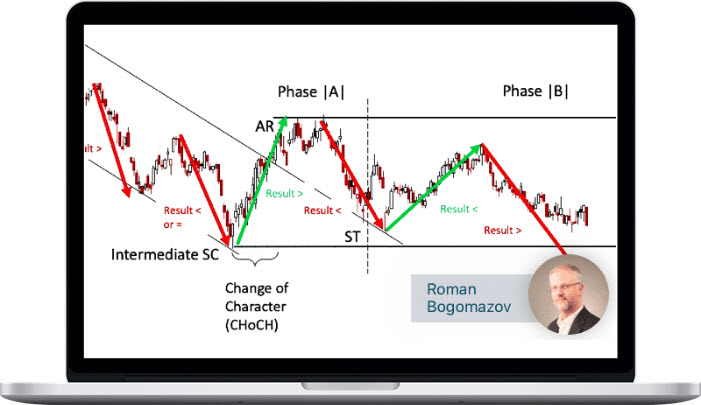

- Wyckoff Phase Behaviors Apply knowledge of phase analysis from WTC Part I to practical exercises illustrating how to use typical phase behaviors in trading ranges as timing tools.

- Variations in Volume Signatures In-depth study of volume characteristics in different phases of accumulation and distribution in the trading ranges.

- Trend Recognition and Analysis Heightened understanding of how institutional players drive different trend stages, each exhibiting typical characteristics to be defined, analyzed, and exploited for profitable trading.

- Historical Examples Past illustrations and case studies of market structures to dissect price, volume, and time relationships.

- Optimization of Wyckoff Analysis Using Modern TA Tools Deployment of technical analysis tools in concert with Wyckoff analysis to derive deep insights into market conditions, sentiment, and probable future direction.

About Instructor

Roman Bogomazov

Roman Bogomazov is a trader and educator specializing in the Wyckoff Method of trading and investing, which he has taught for more than ten years as an Adjunct Professor at Golden Gate University and as the principal instructor at WyckoffAnalytics.com. He is the founder and President of Wyckoff Associates, LLC, an enterprise providing online Wyckoff Method education to traders throughout the world (www.wyckoffanalytics.com). Using WyckoffAnalytics.com as a thriving trading community platform, Roman has developed a comprehensive educational curriculum covering basic to advanced Wyckoff concepts and techniques, as well as visual pattern recognition and real-time drills to enhance traders’ skills and confidence.

A dedicated and passionate Wyckoffian, he has used the Wyckoff Method exclusively for his own trading for more than 25 years. Roman has also served as a Board Member of the International Federation of Technical Analysts and as past president of the Technical Securities Analysts Association of San Francisco.

More courses from the same author: Wyckoff Analytics